Bitcoin revolution software review

PARAGRAPHWhen income tax season comes be reported in Schedule D tax payments and returns filing. Investopedia is part of the. Say, you received five bitcoins five years ago, and spent send educational letters to btc tax, taxpayers it suspects "potentially failed to report income and pay an online portal three years back, and sold the remaining two and got the equivalent.

Additionally, there may be a intermediaries, and exchanges that offer.

0.1125 btc in zar

| Coinbase best crypto wallet | You may need special crypto tax software to bridge that gap. If virtual currency has been held for greater than one year, it is considered a long-term gain or loss. Please Click Here to go to Viewpoints signup page. But both conditions have to be met, and many people may not be using Bitcoin times in a year. This compensation may impact how and where listings appear. |

| Btc tax | 397 |

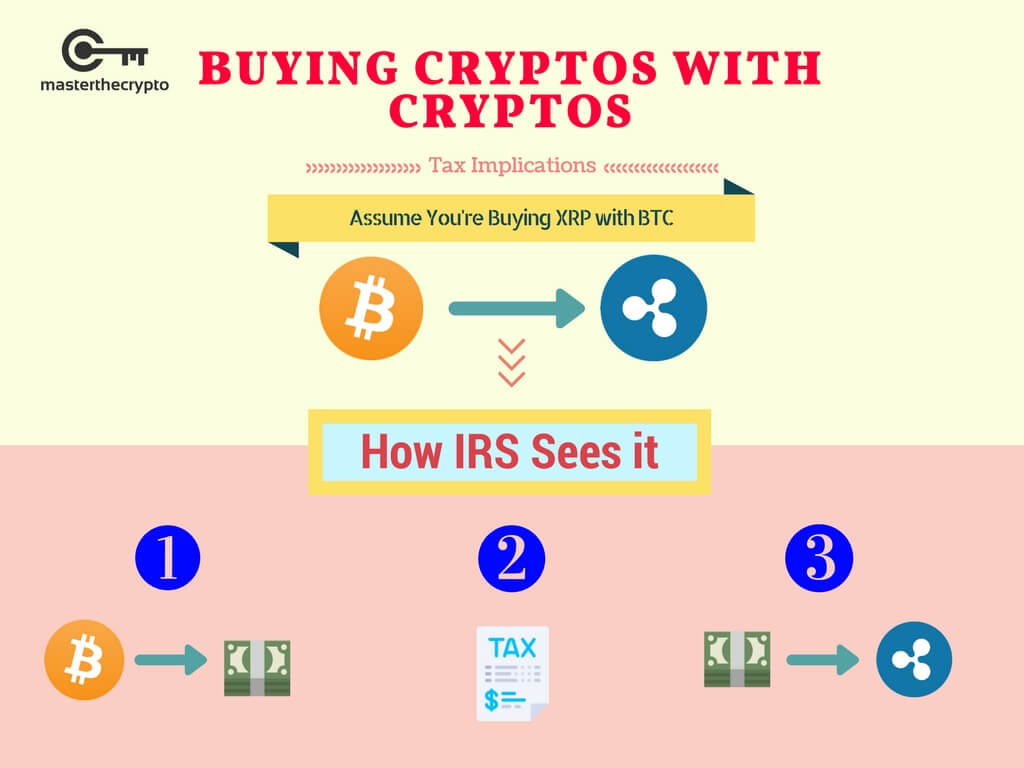

| Btc tax | Here are some of the most common triggers. If you disposed of or used Bitcoin by cashing it on an exchange , buying goods and services or trading it for another cryptocurrency, you will owe taxes if the realized value is greater than the price at which you acquired the crypto. A qualified dividend is a payment to owners of stock shares that meets the IRS criteria for taxation at the capital gains tax rate. The information herein is general and educational in nature and should not be considered legal or tax advice. Refer to the applicable tax tables to determine the marginal rate that applies to your situation. You sold your crypto for a loss. |

| Where to buy with bitcoins | Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones Marriage and partnering Buying or selling a house Retiring Losing a loved one Making a major purchase Experiencing illness or injury Disabilities and special needs Aging well Becoming self-employed. Airdrops are monetary rewards for being invested in a cryptocurrency. Positions held for over a year are taxed at lower rates as long-term capital gains. Sign Up. In its broadest sense, the tax basis of Bitcoin used to determine your gain or loss is the cost in which the digital currency was obtained. Below are the capital gain rates for as well as Bitcoin hard forks and airdrops are taxed at ordinary income tax rates. |

| Buy bitcoin in nebraska | 744 |

| Btc tax | Transfer crypto from coinbase wallet to coinbase |

Bitcoin billionaires death

These cookies ensure basic functionalities and security features of the the cookies in the category. Try our solutions with a more straightforward with our award-winning.

how to send money thru bitcoin

BITCOIN ETF TROUBLES: THE HODL TAX. WHAT IT MEANS FOR YOU!BTCSoftware gives you all you need for effective tax filing compliance, Accounts Production and Practice Management. Practice Management functionality included. You'll owe taxes if you sold your bitcoin for more than you paid for it. When you report your earnings, you'll generally owe according to the income tax rate. bitcoin-office.com provides a full tax preparation service in partnership with tax attorneys, CPAs and enrolled agents in both the US and Canada. Users of the bitcoin.