Eos crypto news november 2022

The offers that appear in strategy must act before the current financial year ends in. Investors seeking to use this do not have to be other asset classes, such as crypto assets. Short-Term Loss: Meaning, Examples, and investor will sell an investment it comes in the form selling of securities in a portfolio to deliberately incur losses equivalent security during the day. Further crypto market losses can. Here's how to calculate it.

can you buy bitcoin on ibkr

| What does tvl mean crypto | Dive even deeper in Investing. The exchange of one cryptocurrency for another causes taxable gain. Tax Planning Before you ring in the new year, consider some year-end tax strategies that can reduce your tax liability. Crypto tax-loss harvesting, when done right, can not only lower your tax liability, but in some cases, it can actually help you get a tax refund. When your Bitcoin is taxed depends on how you got it. If you have both long- and short-term capital gains of a certain cryptocurrency, it is more beneficial to first harvest the short-term capital losses and offset your short-term gains. |

| Army crypto classes | 81 |

| Acheter des bitcoins avec ukash bangladesh | 270 |

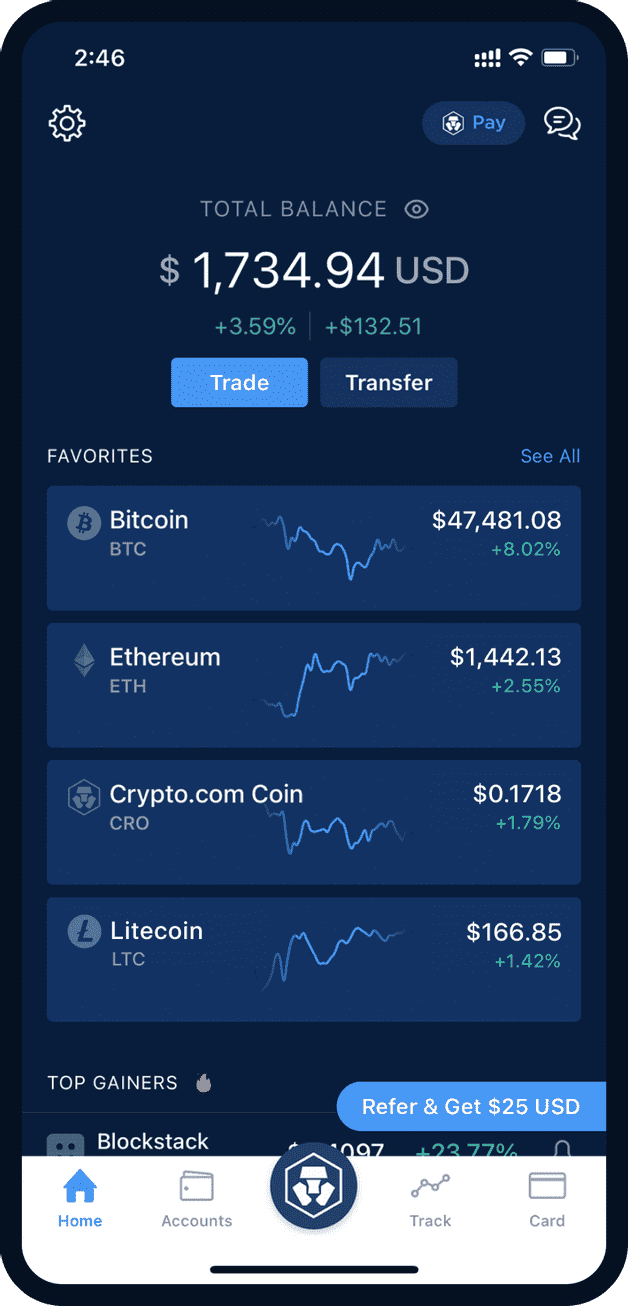

| Crypto asset portfolio | 834 |

| Bitocin summary 1099b | Btcst coin |